06.11.2023

What you need to know about securitization – a mechanism for refinancing assets with the help of securities, which will be especially relevant for the post-war reconstruction of the country.

The National Securities and Stock Market Commission (NSSMC), together with LIGA.net, has prepared a series of publications to explain the essence and specifics of financial instruments and mechanisms of their use in a simple and accessible way.

In previous publications, we have reviewed the economic essence, characteristics and peculiarities of the use of fundamental derivatives – forwards, options and swaps, as well as second-wave derivatives – credit derivatives.

Today, we are moving on to consider securitization. Simply put, securitization is a mechanism for refinancing assets through the issuance and placement of securities. As a rule, assets with low liquidity or not subject to free circulation are transformed into securities.

How it all started

The first case of securitization (in the format that we are familiar with today) took place in 1970 in the United States. At that time, a generation of Americans born during the postwar baby boom was growing up and needed their own homes.

In most cases, the purchase of housing was made with mortgage loans, the payments on which are stable and predictable. Therefore, the U.S. Department of Housing and Urban Development issued debt securities, the repayment of which was secured by future mortgage proceeds.

Thus, the initiator of the securities issue received capital today, and the investors of the securities received guaranteed payments over the years. As a result, sustainable housing construction was ensured through the sale of securities that were repaid from mortgage proceeds.

Popularization of the mechanism in the United States and Europe

The securitization process was widely used and improved in the United States and Europe in the 1980s: the economy was growing, public optimism was strengthening, citizens were actively taking out loans, corporations had stable and growing profits, and investors were investing in long-term financial instruments.

These were ideal conditions for the development of financial markets. Lenders began securitizing any future cash flows that could be predicted in any way, but the most common asset for securitization was a portfolio of mortgages.

According to statistics, the volume of structured securities placed in 2022 amounted to €203 billion in Europe and €2.5 trillion in the United States. At the same time, the total value of mortgage-backed securities placed amounted to EUR 1.9 trillion. This indicates that securitization is one of the most efficient and reliable mechanisms for raising funds, especially for revitalizing mortgage lending.

How does securitization work in practice?

Two key conditions are necessary for the mechanism to work: future cash flows and their predictability. For example, mortgages have a clear repayment schedule, so cash flows can be easily predicted and securitized. For this reason, mortgages are most often securitized assets.

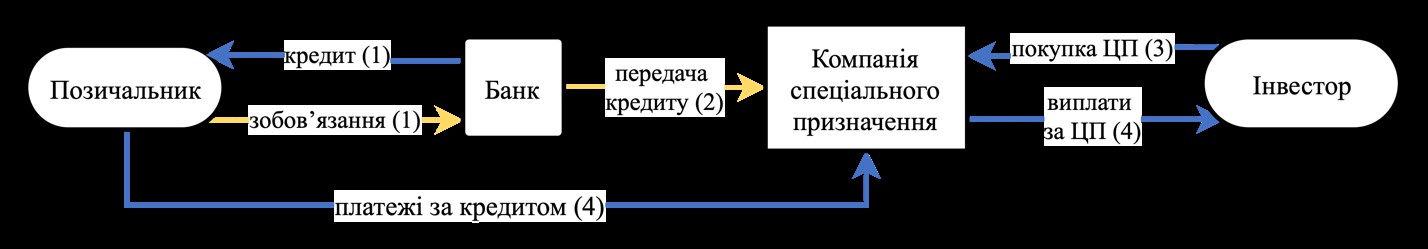

Securitization takes place in several stages (see diagram): first, a bank issues a loan to a borrower (1), then the bank transfers the loan to a special purpose vehicle (2), then the special purpose vehicle issues securities backed by the loan (3), and finally, loan payments are transferred to investors (4).

Basic scheme of securitization

Why does Ukraine need securitization?

There has long been no doubt that the war will end in Ukraine’s victory and that international partners will allocate funds to rebuild our country, and this will require the use of financial instruments that are quite understandable to international partners but new to Ukraine.

The advantage for us is that we are not starting from scratch – we have a chance to benefit from the experience of the financial community of developed countries and use an already polished mechanism that has been through several crises and has been worked on.

On February 14, 2023, the NSSMC approved the Concept for the introduction of a legal framework for covered bonds and securitization in Ukraine. This decision is timely and necessary, as Ukraine needs more than $400 billion to restore the damage caused by the war, and this figure is growing every day, as a result of Russian aggression. We must use the already established mechanism with proven efficiency to revive the national economy.

In the following publications, we will consider the classification of securitization, mechanisms for improving credit quality, requirements for participants in the securitization process, and examples of use (both the most common and the most exotic).

The text was prepared by the NSSMC specially for LIGA.net

Зв'язатися з нами