27.11.2023

What you need to know about the main participants in securitization and the reasons for their involvement in transactions

The National Securities and Stock Market Commission (NSSMC), together with LIGA.net, has prepared a series of publications to explain the essence and specifics of financial instruments and mechanisms of their use in a simple and accessible manner.

In the previous publication, we reviewed the most common types of securitization, when and for what purposes they are used. In this publication, we will look at the participants in the securitization mechanism, in particular, hedging providers (improving the quality of structured securities).

Securitization is an innovative technique for refinancing the primary lender’s activities and/or redistributing risks through securities backed by the proceeds of a reference portfolio that is transferred to a target company. From the financial engineering perspective, this mechanism can be viewed as a two-tiered structuring.

Thus, the first level of structuring is the selection, separation and transfer of the asset pool to the special purpose vehicle. At the second level, risks are redistributed among investors by placing securities of different classes by the special purpose vehicle.

Effective securitization requires a compromise between all parties to the transaction. At the same time, some participants are mandatory for the transaction, while others are involved to improve the quality of the transaction itself.

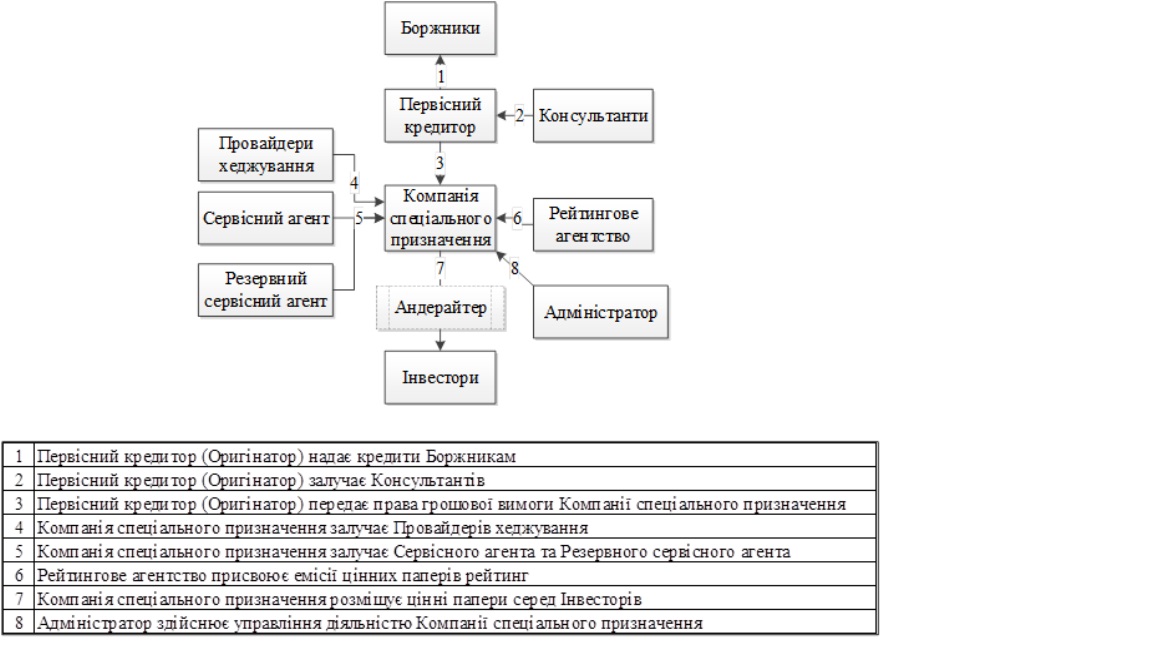

Let’s look at the main participants, which are presented in Scheme 1.

Debtors are those who have a contractual relationship with the Original Lender and are the ones who will generate the future cash flows that will form the basis for the securitization.

The Original Lender (Originator) can be any entity that is capable of creating a portfolio of assets that will generate cash flows in the future.

Special Purpose Vehicle (SPV) is a legal entity that has been established for the exclusive purpose of issuing securities, acquiring rights to a reference pool of assets and transmitting cash flows to investors in accordance with the language of the transaction. A key feature of such a person’s activities is that its relations with third parties should be minimal in order to minimize the risk of bankruptcy of such a person.

Administrator is a person whose main purpose is to manage the cash flows of a special purpose vehicle.

Investors are persons who have purchased securities issued by a special purpose vehicle with different levels of income and risk.

Of course, when the quality of the assets is high and the rating of the originator is beyond doubt among potential investors, securitization can be carried out without involving additional participants. However, in practice, this simplified configuration is rarely used.

So, who should be additionally involved in the process of structuring the transaction to ensure that it meets the expectations of the main actors?

Scheme. 1. General scheme of classical securitization

First, it is worth engaging advisors who already have experience in similar transactions and can offer a more efficient transaction configuration in advance. This means that consultants can provide advice on asset selection criteria, choice of securitization type and payment structure, and involvement of hedging providers. It is also worth engaging advisors to maximize the efficiency of the securities offering, as different jurisdictions may have different asset preferences and different capital market capacities.

Secondly, it is advisable to engage a rating agency to assign a rating to the securities issue. An investment-grade rating will expand the range of potential investors and, accordingly, increase the volume of securities placed.

Thirdly, a service agent is needed – a legal entity responsible for receiving funds from debtors. This role is usually performed by the banks that originated the transactions or other financial companies licensed to provide payment services. The main disadvantage of such a person is that it conducts ordinary business activities and therefore faces the risk of bankruptcy, which may affect the execution of the transaction.

It is for this reason that a backup service agent is engaged to replace the original service agent if the latter is unable to perform its function.

Fourthly, it is extremely important to engage hedging providers to improve the efficiency of the transaction. Given the possibility of numerous risks, the process of continuous monitoring of risk factors (delayed payments, debt restructuring, bankruptcy, rating downgrades) begins with the start of the transaction, which may lead to a breach of the obligations assumed by the parties to the transaction due to technical reasons, conflicts of interest or refusal to recognize their own obligations.

Risk management should be carried out at all stages of a securitization transaction, but it is most important at the stage of structuring the transaction, as it allows avoiding or at least minimizing most potential risks.

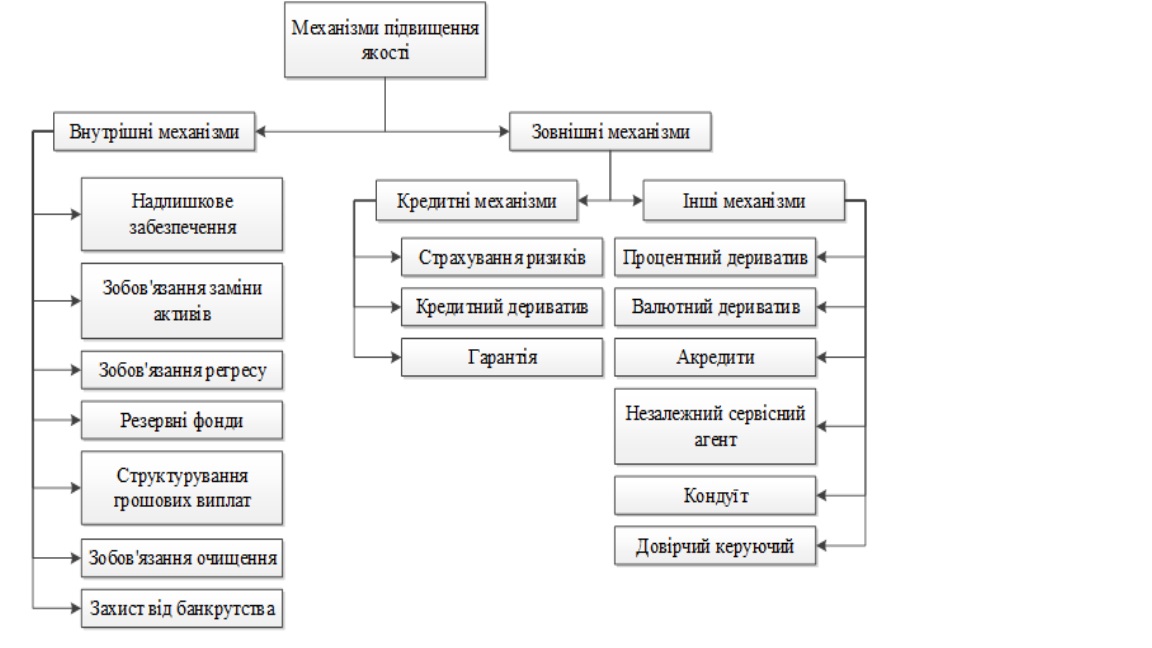

Scheme. 2. Structure of deal quality improvement mechanisms

Unlike the most common risk management mechanisms for conventional financing, securitization requires specialized tools that will minimize risks through internal mechanisms and/or transfer risks to others through external mechanisms.

Internal quality enhancement mechanisms are provided by a special purpose vehicle, a target company or the original lender and consist of structuring cash flows that are binding even in the absence of evidence of borrower default.

The use of external mechanisms to improve the quality of transactions involves the involvement of third parties willing to assume risk in exchange for appropriate remuneration, which often allows the securities issue to receive the highest rating, as not only the payment structure and asset quality, but also the characteristics of third parties will be assessed.

During the course of the transaction, it may become apparent that the chosen transaction configuration is not effective due to errors in structuring the transaction itself or due to unforeseen events. In this case, the so-called “reset” of the reliability enhancement mechanisms is carried out in order to optimize the transaction.

It should also be noted that in the context of martial law, domestic issuers face difficulties in raising funds due to significant risks for foreign investors. In this context, war risk insurance, which the Ukrainian government is constantly working on, has great potential and relevance.

Today, the Ministry of Economy of Ukraine expects seven war risk insurance projects to be launched by the end of 2023:

- three insurance projects from the Multilateral Investment Guarantee Agency (MIGA) of the World Bank Group;

- four insurance projects from the U.S. International Development Finance Corporation (DFC).

Conclusions.

Each securitization transaction is unique and requires a unique configuration, and the question of whether to prefer internal or external mechanisms will always be controversial. The complexity of the choice is due to divergent interests of key participants, the need to achieve the target level of the issue rating, the list of parties involved in the securitization, the variety of asset types underlying the reference portfolio, and the combination of risks inherent in certain types of securitization.

In the next publication, we will provide readers with the most exotic examples of securitization.

The text was prepared by the NSSMC specially for LIGA.net

Зв'язатися з нами